According to a new report released by FTR Trucking Intelligence, heavy-duty truck orders are holding steady, while high demand and manufacturing constraints continue to cause truck availability and pricing problems.

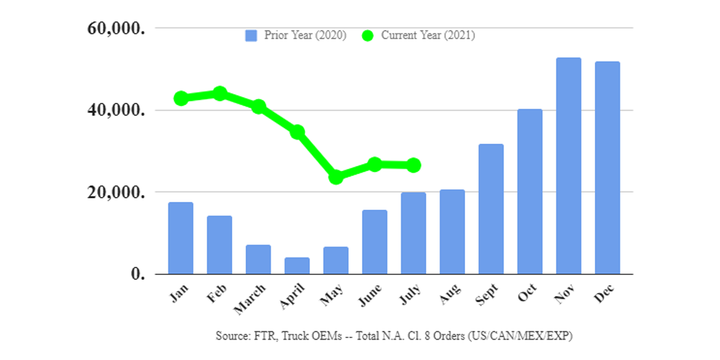

In July 2021, orders for Class 8 trucks in North America were between 25,800 and 26,500 units. That’s about 1% less than July 2020 and almost identical to June 2021’s truck sales.

Truck orders have increased 25% year over year, with a total of 394,000 Class 8 truck orders over the past 12 months. This time of the year is at the bottom of the order cycle, as trucking companies wait to release next year’s models. Some brands started offering orders for 2022 models in July, but due to cost uncertainty and continued supply chain bottlenecks, there have been delays. The industry needs trucks, but high costs, especially for commodities, is keeping vehicle prices high. It’s uncertain if these prices will persist for the foreseeable future, or they will drop as production returns to normal.

Like the rest of the automotive industry, truck manufacturers are having trouble with semiconductor shortages. This is currently the biggest bottleneck for production. FTR estimates the supply of heavy-duty trucks is around 25% below market demand. Production is booked well into the first quarter of 2022, and manufacturers won’t be able to catch up until they have a steady supply of electronic components.

According to ACT president and senior analyst Kenny Vieth, a boom in trucking is also driving demand. This the result of a combination of factors: GDP growth over 6%, capacity constraints across shipping modes, near-record trucking freight rates, increases in carrier profits and record used equipment evaluations. In other words, trucking companies need more trucks on the road to meet demand, and they have the cash for new equipment.